Want to have a say on rent and other matters?

Why not consider becoming an involved tenant? We are looking for people who are happy to comment on our services and help us improve.

In April 2024, your rent will go up by 7.7%. You will receive a letter in March with all the information you need. Here are the facts and some useful links to help and support. Above all, speak to us if you are struggling to pay. We are here to help.

This year’s rent increase will be 7.7%. This will be from 1 April 2024.

The year 2024-25 is an unusual year that arises every 5-6 years. Instead of the usual 52 weeks, there are 53 weeks in the rent calendar year. In other words, this coming year there are 53 Mondays when rent is due.

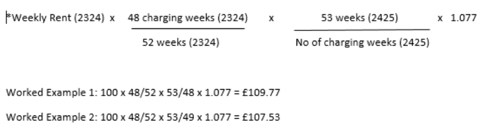

The number of non-charging weeks will vary dependent on your tenancy agreement. The below will show you how this would look.

|

|

2023-24 |

2024-25 |

||

|

|

Weekly Rent (£) |

Weeks Charged |

*Weekly Rent (£) |

Annual Rent (£) |

|

5 non charging weeks |

100 |

48 |

109.77 |

5,269.02 |

|

4 non charging weeks |

100 |

49 |

107.53 |

5,269.02 |

*The new weekly rent for your property is calculated as below: (23-24 refers to rent charges between April 2023 – March 2024 and 2425 refers to rent charges between April 2024 – March 2025).

If you are a shared owner, the increase will in line with your lease. Leases outline the relevant review month. The increase will be the RPI of that month plus 0.5%.

For example, if the review month in lease is September the rental increase will be 9.4%. RPI in September 2023 was 8.9%.

Here's the short explanation:

52 weeks x 7 days = 364 days, which results in one remaining day each year. With a Leap Year, a 53rd week is added to the calendar.

Here's the longer explanation:

There will be 53 Mondays in the 2024/25 financial year which runs from 1 April 2024 until Sunday 6 April 2025 (the new rent year in 2025 will commence 7 April 2025)

This happens every five or six years because there are 365 days in a year or 366 in a leap year. This breaks down to 52 weeks in a year plus 1 day – or, in a leap year, 52 weeks plus 2 days. These extra days accumulate to add an extra week to the year.

We have given the rent increase a lot of thought and discussed it with our Board and involved customers.

With guidance from the government, housing associations set their rent using the Consumer Price Index (CPI) plus 1%. The CPI in September 2023 was 6.7% that means the increase is 7.7%.

Prices across everywhere are increasing – for everyone.

We know costs are increasing for you. But they're increasing for us too. It's more expensive than it was last year for us to maintain your homes and deliver our services due to inflation.

This means that we have no choice but to increase your rent from April 2024 so that we can continue to maintain your homes, keep them safe and deliver on our promises over the next 12 months.

Your new rent will be in your letter. Here are some examples to give you an idea of how much this percentage increase can really mean.

Our lowest rent is a social rent of £76.32 per week, which would increase to £83.78.

This is for a studio flat on the Weston in Macclesfield.

The highest rent we currently charge is £299.60 per week which would increase by £22.56 to £322.16. This is for a 3 bedroom affordable rented house in Little Bollington, Altrincham.

Remember that your rent is charged each Monday and is due in advance. Contact us if you want to check how much you should be paying, especially if you are paying 4-weekly or monthly.

We want to help anyone who is struggling to pay their rent and service charges.

We can help you avoid rent arrears and other debts.

We have an expert Tenancy Sustainment Team and Income Team who want to talk to you and support you.

They can:

Please take advantage of this service to help you manage the rent increase.

You can email trust@peaksplains.org or call us on 0800 012 1311.

If you are in a rented property and pay social rent, your service charges may increase.

This is in line with our Service Charge Policy.The policy states we will set charges appropriately to cover the cost of providing services.

Some tenants will see a surplus brought forward from the previous year – because we operate variable service charges. This surplus relates to the previous financial year, where the cost of services was lower than estimated. This surplus has been carried forward, and deducted from your total service charges in 24-25.

We want to make sure our charges are affordable and that increases are reasonable. For this reason, where necessary, we have applied a discount so that the full increases are not passed on to you straightaway. If your service charge increase is higher than the cap we have set, the Trust will subsidise the remainder of your charge, so you continue to receive the full services. If this applies to you it will be shown on the rent letter as a ‘service charge discount’.

Should you have a query specific to the service charges you have been asked to pay ,you can contact the Trust on 0800 012 1311, email servicecharges@peaksplains.org or complete the online form on the service charge web page.

Tenant service charges - what they cover and how we work them out (peaksplains.org)

More information can be found on your rent letter (you will get this at the beginning of March 2024) and the Trust website.

Tenant service charges - what they cover and how we work them out (peaksplains.org)

If you are on Universal Credit, this is assessed and paid every month. Universal Credit is calculated on a 52-week basis but only pays 364 days in a year, so is always a day short (or two if there is a leap year.)

This is because when the Department for Work and Pensions (DWP) works out your monthly rent, it multiplies a week’s rent by 52 (weeks of the year) times by 7 (days a week) which works out at 364. It then divides this by 12 (months).

This would be fine if there were exactly 52 weeks rent in a year – but there aren’t. There’s always an extra day in the year, or two in a leap year, which is the case in 2024.

If you don’t pay that extra day yourself, this then can ‘catch up’ with you once every 5 or 6 years – ie whenever there are 53 Mondays in a financial year. Unfortunately, 2024/5 is one of those years.

The DWP has said it will not pay any extra Universal Credit to cover this. The only way to avoid falling into arrears is by paying a little extra each week to ensure your rent is covered.

What do I need to do if I am on Universal Credit?

The DWP only pay up to 52 weeks of rent per year and works out the weekly rent for those on Universal Credit by taking the total yearly amount and dividing it by 52 weeks. For example, £10,400 per year / 52 weeks = £200pw rent.

Unfortunately, they have confirmed that they won’t pay for the 53rd week. This means you will need to pay for the additional week yourself.

To lessen the impact, we recommend you pay a little bit each week over the year.

For example, if you pay £200 a week for your rent, you could divide this by 53 weeks and pay £3.78 a week for 53 weeks.

It is your responsibility to make sure that the DWP knows about this change to your rent so that they can adjust your payment. We can’t do that for you.

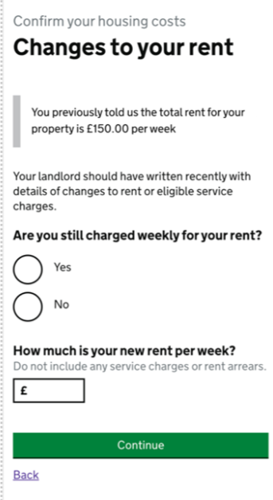

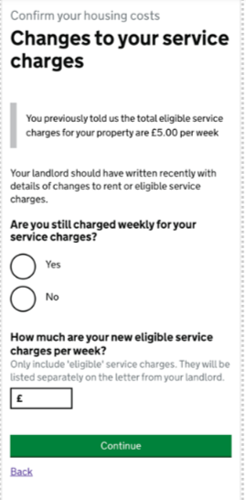

How to do this:

www.universal-credit.service.gov.uk/sign-in

The DWP will add a ‘Confirm your housing costs’ to-do request.

You will be asked to complete the ‘to-do’ by the end of your assessment period to ensure that you get the correct housing payment.

Then check your journal to confirm that it shows you have done this.

If you forget, do this as soon as possible. If you do not update your account, you risk receiving an incorrect payment and falling behind on your rent.

Then you’ll need to increase your payments to us. Contact the income team and we’ll help with this income@peaksplains.org or call our Freephone number 0800 012 1311.

That depends on where you live

We will notify the Housing Benefit team at Cheshire East Council of your new rent. They will then let you know what you will need to pay.

You must notify the Housing Benefit team at Cheshire West & Chester Council of your new rent. They will then let you know what you will need to pay.

You must notify the Housing Benefit team at High Peak Borough Council of your new rent. They will then let you know what you will need to pay.

No we’ll do this for you and we’ll write to you to confirm your payment schedule for the next 12 months.

Ask your bank to change your standing order (or you can do it yourself if you use online banking).

You need to adjust the amount that is sent to us. Times it by the frequency that you pay us – like this.

If you have an agreement with your Income Officer to pay an amount off arrears, you will need to add this on to your payments to us.

If you’re unsure what you need to pay, contact your income officer.

Remember, your tenancy agreement states that you pay your rent one week in advance.

All the money that the Trust receives from rent and service charges goes towards building, caring for and maintaining our homes.

From repairs and improvements to new homes and running the Trust.

In April 2023 we launched our new Corporate Plan that outlines what we will do over the next five years.

Here are our objectives.

Each year we also publish an Annual Review which states very clearly how we have spent your rent and how we are performing against the plan’s objectives.

Our Board and our ‘involved tenants’ also look closely at our performance and how well we spend your money.

Absolutely. The reason we are applying the rent increase is so that you will see benefits both within your own home – for things like routine repairs – and across the wider community.

You can find out more about what’s happening in your area in our Neighbourhood Plans.

You can look at your rent statement online by registering on our website at

www.peaksplains.org/myaccount.

It shows the balance on each of your accounts, along with the current charge details.

To see a full statement, click on the link against the account and it will show you all your transactions.

If you do not have a computer, tablet or smart phone you can contact the Income Team on 0800 012 1311 and they will send you a rent statement.

We can’t discuss your neighbour’s tenancy with you, of course.

But differences can occur because of tenancy type or the rental history of your home.

Your rent is calculated according to the rules set out in the Direction on the Rent Standard 2019, supported by the policy statement on rents for social housing.

If you are struggling to pay your rent or your other bills we want to help. Often we find the earlier people seek support the better.

We have a team of skilled staff that can give you advice on benefits, money management and support you when things change in your life. We are experienced at finding practical solutions for our tenants to support them with arrears or debt.

We can signpost you to organisations who can help with things such as debt and budgeting, disability support, food surplus pantries as well as many more:

Here are some of our partners and bit about how they can help too.

Our staff can help you to apply for Employment Support Programmes like New Leaf and Springboard, which aim to help you get on with training, education and/ or work.

Email trust@peaksplains.org and asked to be referred to these Employment Support Programmes.

LEAP is a free service that is helping people keep warm and reduce their energy bills without costing them any money. See how you can save.

• Visit www.applyforleap.org.uk

• Freephone 0800 060 7567

• Email support@applyforleap.org.uk

Cheshire East can help with Council Tax Support (CTS) gives you a reduction on your Council Tax bill if you are on a low income. You will get a revised Council Tax bill with a reduced balance.

Visit: cheshireeast.gov.uk/benefits_housing_council_tax/council-tax-support.aspx

High Peak Council can help you to understand if you are eligible for ‘council tax reduction’.

Visit: https://www.highpeak.gov.uk/article/603/Apply-for-a-discount-or-exemption

Cheshire West has online information about its Council Tax reduction scheme.

Visit: https://www.cheshirewestandchester.gov.uk/residents/council-tax/council-tax-reduction

Entitledto is an independent online benefit calculator that helps people to work out what they can claim from national and local government.

Visit: entitledto.co.uk

• Money Helper is a free online budget planning tool.

Visit: moneyhelper.org.uk/en/everyday-money/budgeting/budget-planner

• They can also help you to manage your debt.

Visit: moneyhelper.org.uk/en/money-troubles/dealing-with-debt

Yes, from April 2024 the following weekly rents will apply to our garages and motorbike stores:

Tenant charges

(If you also rent your home from us.)

Non tenant:

Why not consider becoming an involved tenant? We are looking for people who are happy to comment on our services and help us improve.